who claims child on taxes with 50/50 custody

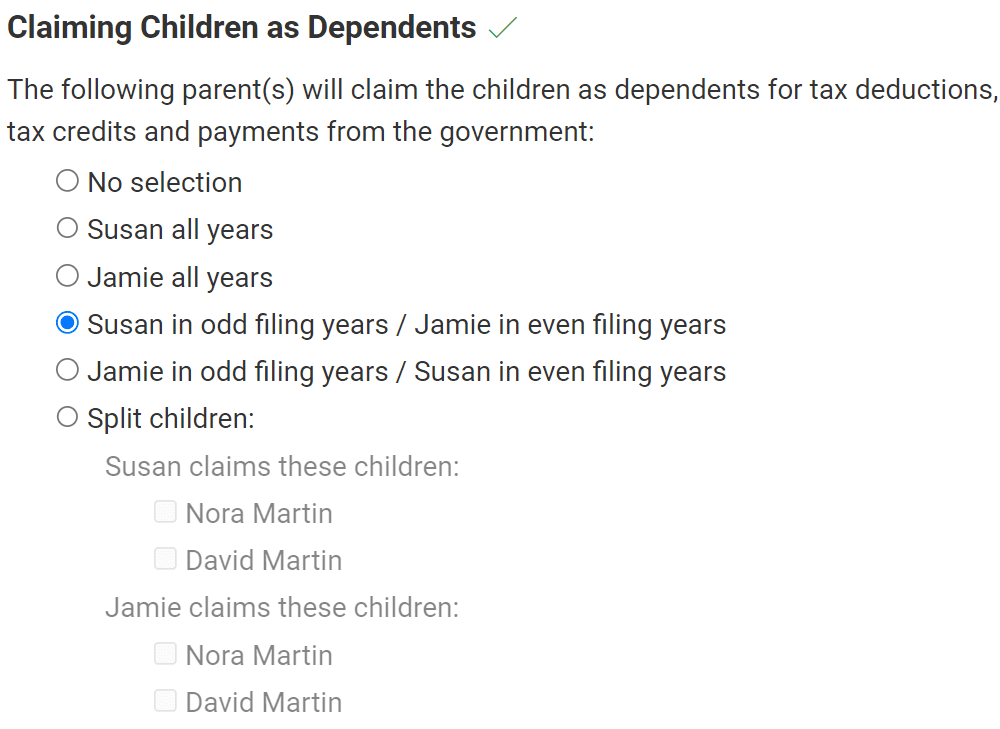

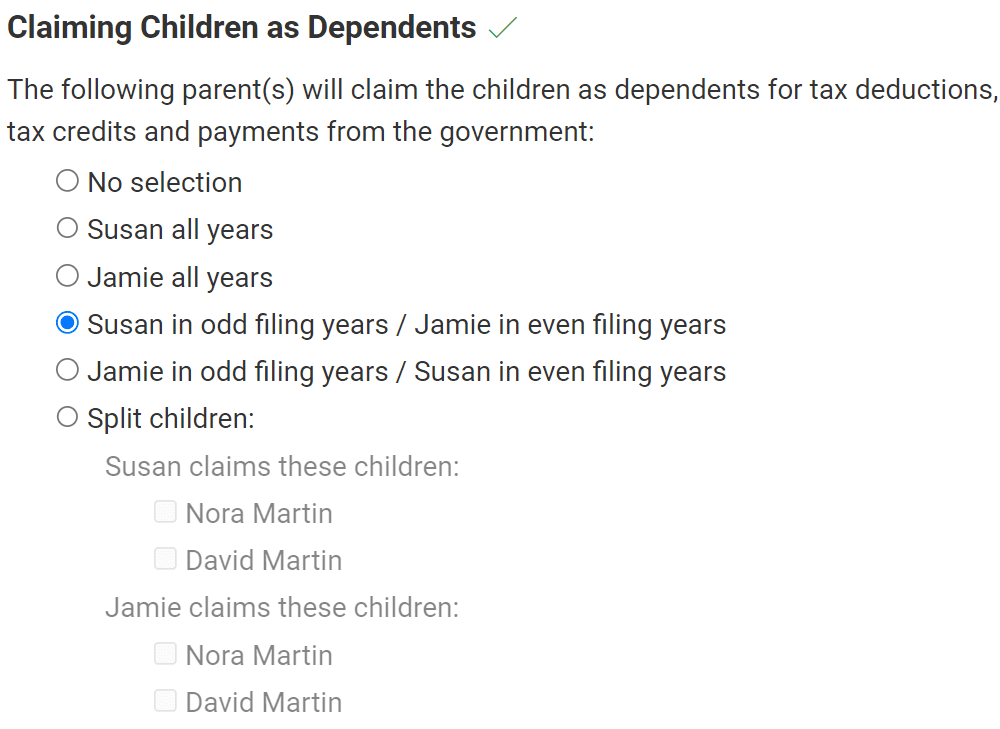

A release has been signed. Equal The parent who qualifies as the custodial parent under federal tax law is the one who claims the children as dependents.

How Do You Claim A Child On Taxes With 50 50 Custody

What Happens When Both Parents Claim A Child On A Tax Return How Claiming The Child Tax Credit Typically Works Loss Of Child Tax Credit Child Tax Benefits For Custodial Parents Since.

. Understand the common factors Pennsylvanias judges use when making child custody decisions. The Internal Revenue Service IRS typically. However if the child custody agreement is 5050 the IRS allows the parent with the.

Who Claims Child on Taxes With 50 50 Custody. Who Claims the Child With 5050 Parenting Time. Get Free Child Custody Lawyer Contacts and Legal Guidance Immediately.

Find the one nearest you. For a confidential consultation with an experienced child custody lawyer in Dallas. If either parent has signed a Release of Claim to Exemption for Child of Divorced or Separated Parents that individual will have essentially forfeited his or her right.

Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim the child. Snowwhite1983 15012019 1924. The parent with whom the child.

The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household. Who Claims a Child on Taxes With 5050 Custody. We Help Taxpayers Get Relief From IRS Back Taxes.

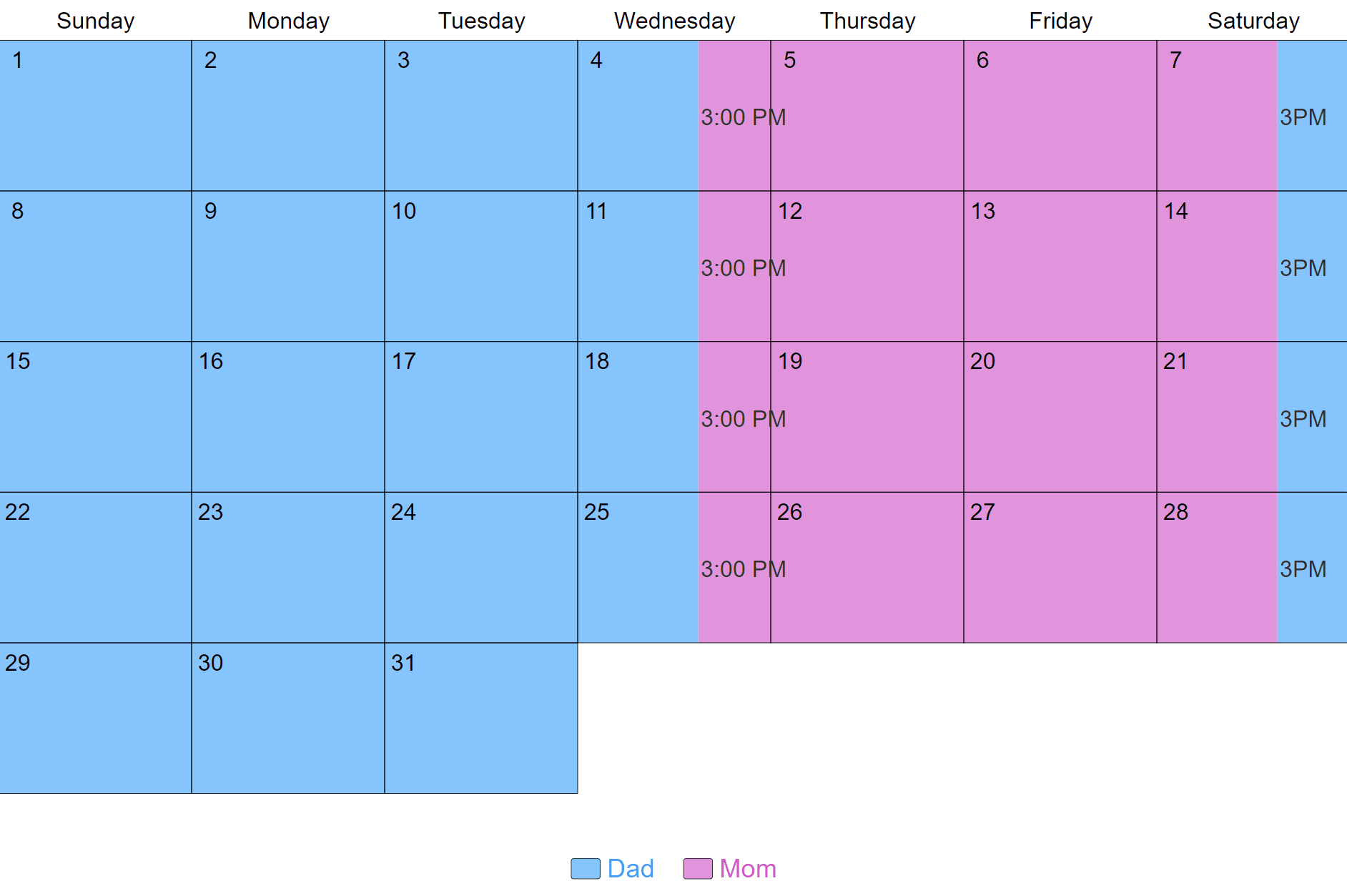

Having a child may entitle you to certain deductions and credits on your yearly tax return. In some cases divorced or unmarried. My soon to be ex husband and I have decided to go for shared parenting with an exact 50.

In instances where parents share equal 5050 custody and the percentage of nights were equal the parent who makes the most money would get the right to claim the. So the parent with the higher adjusted gross income gets to claim the child as a dependent on their taxes even if they spend. Ad Based On Circumstances You May Already Qualify For Tax Relief.

But if the custody agreement mandates that its a 5050 split then the parent with the higher adjusted gross income gets to claim it. Assuming this is a 5050 custody arrangement between two parents with no third party involved and the parents dont file a joint tax return the priority would be. The person who provided physical custody of the child for more than 50 of the year can claim the child as a dependent regardless of whether or not back child support is owed.

Ad A Full List of Free Child Custody Lawyers Contact Information. California law states that in split 5050 child custody agreements the parent with the higher income can claim the child as a dependent on taxes. In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns.

This is true for parents without an exact 5050 custody split. But there is no option on tax forms for 5050 or joint custody. Who Claims a Child on US Taxes With 5050 Custody.

However parents who evenly split custody have other factors to consider. The court has ruled joint parenting time or custody with both you and your spouse spending approximately equal time with your child. The custodial parent as defined by the IRS claims the child tax credit in a 5050 division.

However most cases involve. Child tax credits with 5050 shared custody44. In general the parent who houses the child for most of the year is going to count as the custodial parent.

Usually the IRS allows the parent with whom the child has lived most of the tax year to claim the child. How Pennsylvania Courts Make Child Custody Decisions. Who Claims a Child.

Florida 50 50 Parenting Plan 50 50 Custody And Child Support

Do I Have To Pay Child Support If I Share 50 50 Custody

Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer

4 3 Custody Visitation Schedules How Does It Work Pros Cons

How Do You Claim A Child On Taxes With 50 50 Custody

Do I Have To Pay Child Support If I Share 50 50 Custody Lawrina

Child Support And 50 50 Custody In Illinois Updated March 2022

50 50 Custody Are Courts Biased Against Men Graine Mediation

50 50 Joint Custody Schedules Sterling Law Offices S C

Who Claims Child On Taxes With 50 50 Custody Colorado Legal Group

Why Do I Pay Child Support With 50 50 Custody Timtab

Who Claims A Child On Us Taxes With 50 50 Custody

Who Claims A Child On Taxes In A 50 50 Custody Arrangement

How Do You Claim A Child On Taxes With 50 50 Custody

50 50 Custody And Visitation Schedules Common Examples Ciyou Dixon P C

Child Joint Custody Agreement Template Custody Agreement Separation Agreement Template Separation Agreement

Does Joint Custody Mean Neither Parent Pays Child Support Renkin Law